Otherwise, the IRS may determine your business is a hobby and disallow expenses.

Even if your small business faces financial problems and doesn’t actually generate a profit, the intent needs to be there. Those “ordinary and necessary” expenses must be incurred in an organization motivated by profit. Start by reviewing Internal Revenue Service Publication 535, which discusses the deductibility of common business expenses and general rules for filing your taxes. Which expenses may be written off varies depending on the nature of your business. What Is a Tax-Deductible Business Expense? That makes it well worth the time to organize your spending so your business takes all legitimate write-offs, creates an effective financial plan, pays the proper amount in quarterly taxes-and doesn’t need to sweat an audit. As long as an expense is “ordinary and necessary” to running a business in your industry, it’s deductible. Given that broad mandate, the IRS doesn’t provide a master list of allowable small-business and startup deductions. As long as the space is exclusively used for business, you can deduct $5 for every square foot, up to $1,500.īusiness expenses are the costs of running a company and generating sales. Or maybe you shuttered your office and started running your company from a spare room. It may seem time-consuming to keep a log separating business and personal use, but you’re losing out on close to $600 in deductions. But some easy moves could significantly lessen your tax bill.įor example, say you’re putting 250 miles per week on your private vehicle to get products out to customers. Sure, you’re focused on customer service and improving your products and services. Middle East, Nordics and Other Regions (opens in new tab)Īttention to expense deductions may not play a prominent role in the financial planning process for small businesses and startups-and that may be costing them.

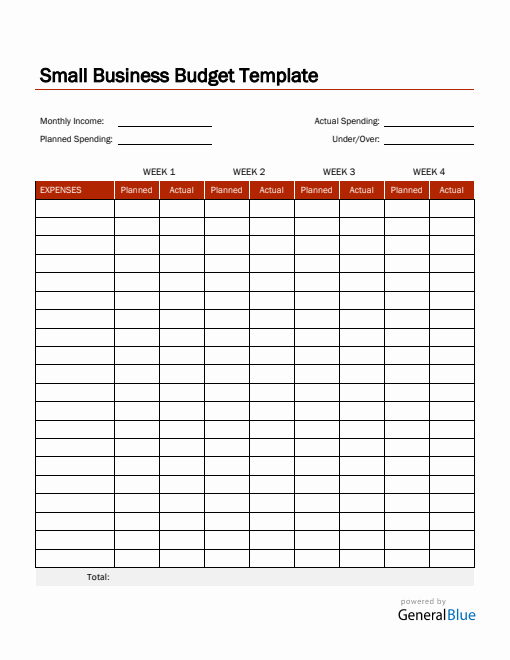

United States / Canada (opens in new tab).Advertising & Digital Marketing Agencies.Advertising and Digital Marketing Agencies.A NET income is also featured to display the difference between the total income and expenses.

The template has formulas so calculations are autogenerated.Ī summary table is provided at the uppermost part so you can easily get an overview of how much your business is making and spending on a monthly and quarterly basis. From your operating expenses, utilities, office supplies, to any other expenses deemed necessary for your business.įor every expense listed above, its amount should also be indicated on the same row. This template is only a sample expense form therefore you have to manually list down your organization’s expenses. With each listed business income, its monthly figure should also be entered on the same row. The first step when using this template is to identify your business’ source of income, e.g., from sales, interest income, etc. Instructions are provided below for your reference.Įnter your business’ source of income along with its monthly figure.

#Monthly business income and expense template download

If this business expense template excel suits your needs, feel free to download it anytime. Sections featured in the form include the monthly income, monthly expenses, NET income, quarterly total, and yearly total. It has simple design therefore using it is extremely easy. The business monthly budget template covers your organization’s monthly, quarterly, and yearly income and spending, all in a single file. This business expense sheet can help you stay on track of your financial goals. Get this company budget template for free.

0 kommentar(er)

0 kommentar(er)